Vadim Ustyuzhanin's presentation for the XI scientific conference “Neighbors in Science”

The conference took place on the Perm campus of the National Research University Higher School of Economics (HSE - Perm).

Ustyuzhanin_Wealth and Rebellion_2024 (PPTX, 3.32 Мб)

The intricate relationship between a nation’s wealth and its political stability has intrigued scholars for decades. Theories have ranged from the assumption that economic hardship spurs citizens to revolt and that countries with lower income are unstable, as posited by Davies (1962) and Przeworski and Limongi (1997) respectively, to the notion that prosperity leads to an increase of instability because of values’ modernization, that is shown by Inglehart and Welzel (2005), or provision of both the resources and the infrastructure necessary for effective organization and mobilization that McCarthy and Zald (1977) noted. In contrast, Huntington (1968) argues that, on the one hand, unmodernized societies with low economic complexity are not “mature” for revolution, while modernized wealth states are too stable and “revolution is thus an aspect of modernization”, so it “is most likely to occur in societies which have experienced some social and economic development” (1968, p. 265). Despite diametrically opposed theories, it is believed that the invisible hand of economics not only guides markets but also weaves the intricate tapestry of societal (in)stability.

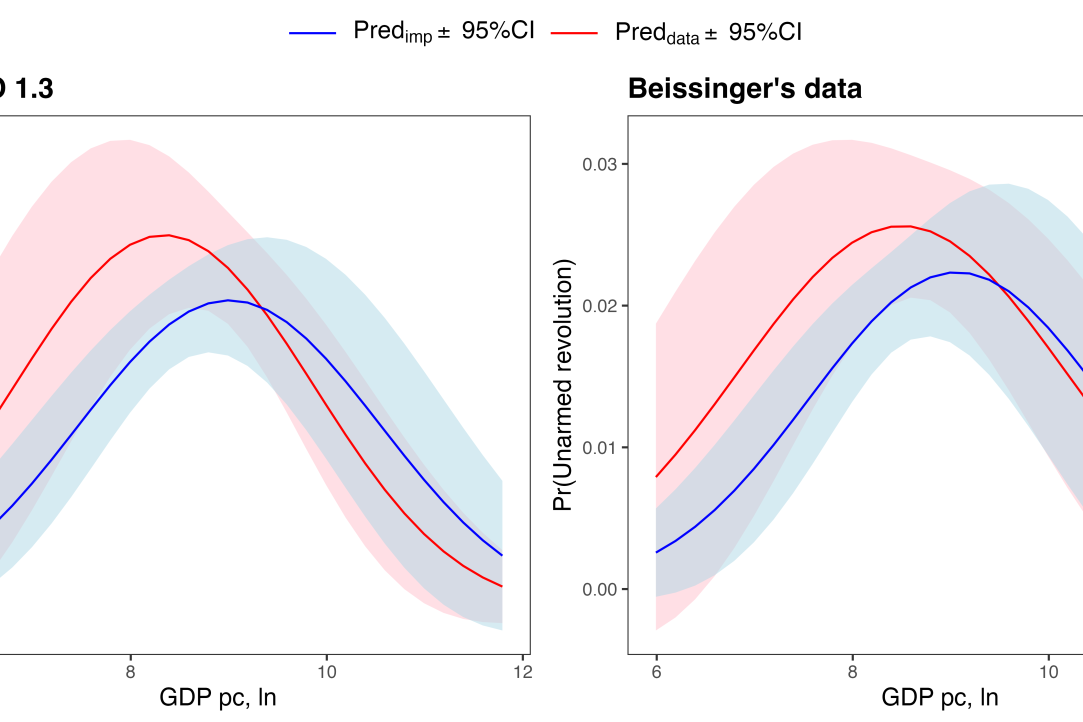

All these studies have in common one thing: they assumed a linear effect of it on risks of unarmed revolutions’ onset. In contrast, in this paper I propose a curvilinear framework that challenges this conventional assumption. Thus, the aim of this study to reconcile the disparate results observed in previous studies by integrating insights from existing literature and introducing a general theory. Using “large-N” empirical approach, two datasets on revolutions, namely NAVCO 1.3 (Chenoweth & Christopher, 2020) and extended Beissinger’s data (Beissinger, 2022; Goldstone et al., 2023), and “rare-events” methods – parametric (bias reduction logistic regression (Kosmidis et al., 2020)) and non-parametric (random forest with quantile classifier(O’Brien & Ishwaran, 2019) and G-mean performance and entropy as split rule) – I show that GDP per capita is crucial factor for understanding both armed and unarmed revolutions, where there is an inverted U-shape form with nonviolent revolutions and linear negative with violent revolutions. These results are supported by different robustness check including using various confounders, multiple imputations technique and cross-validation procedures.